Royal Mint

| |

Type | Government-owned company |

|---|---|

| Industry | Coin and medal production |

| Founded | AD 886 (886) |

| Headquarters | Llantrisant , Wales |

Area served | United Kingdom & British Overseas Territories |

Key people | Anne Jessopp (Chief Executive)[1] |

| Products | Coins Medals Bullion |

| Revenue | |

Operating income | |

| Total assets | |

| Total equity | |

| Owner | HM Treasury |

Number of employees | 900+ |

| Website | www.royalmint.com |

The Royal Mint is a government-owned mint that produces coins for the United Kingdom. Operating under the name Royal Mint Ltd, the mint is a limited company that is wholly owned by Her Majesty's Treasury and is under an exclusive contract to supply all the nation's coinage. As well as minting circulating coins for use domestically and internationally, the mint also produces planchets, commemorative coins, various types of medals and precious metal bullion.[3] The mint exports to an average of 60 countries a year, making up 70% of its total sales.[4] Formed over 1,100 years ago, the mint was historically part of a series of mints that became centralised to produce coins for the Kingdom of England, all of Great Britain and eventually most of the British Empire. The original London mint from which the Royal Mint is the successor, was established in 886 AD and operated within the Tower of London for approximately 800 years before moving to what is now called Royal Mint Court where it remained until the 1960s. As Britain followed the rest of the world in decimalising its currency, the Mint moved from London to a new 38 acres (15 ha) plant in Llantrisant, Wales where it has remained since.

In 2009 after recommendations for the mint to be privatised the Royal Mint ceased being an executive government agency and became a state-owned company wholly owned by HM Treasury. Since then the mint has expanded its business interests by reviving its bullion trade and developing a £9 million visitor centre.

Contents

1 History

1.1 Origin

1.2 886 to 1805

1.2.1 Civil War mints

1.3 1805 to 1967

1.3.1 Tower Hill

1.3.2 Royal Mint Refinery

1.3.3 Colonial Expansion

1.3.4 1914 to 1967

1.4 1967 to present

1.4.1 Move to Wales

1.4.2 Financial Difficulties

1.4.3 Revival

1.4.4 2012 London Olympics

1.4.5 The Royal Mint Experience

1.4.6 Recent Events

2 Operations

2.1 Coin production

2.2 Bullion

2.3 Medals

3 Trial of the Pyx

4 See also

5 References

6 Bibliography

7 External links

History

Origin

Coin of Alfred the Great

The history of coins in Great Britain can be traced back to the second century BC when they were introduced by Celtic tribes from across the English Channel. The first record of coins being minted in Britain is attributed to Kentish tribes such as the Cantii who around 80–60 B.C. imitated those of Marseille through casting instead of hammering.[5] After the Romans began their invasion of Britain in AD 43, they set up mints across the land, including in London which produced Roman coins for some 40 years before closing. A mint in London reopened briefly in 383 AD until closing swiftly as Roman rule in Britain came to an end. For the next 200 years no coins appear to have been minted in Britain until the emergence of English kingdoms in 650 AD when as many as 30 mints are recorded across Britain with one being established in London.[6] Control of Britain's mints alternated as different tribes battled over territory. In 886 AD Alfred the Great recaptured London from the Danelaw and began issuing silver pennies bearing his portrait;[7] this is regarded as the start of the continuous history of the Royal Mint.[8]

886 to 1805

The Tower of London in 1647

In 1279, the country's numerous mints were unified under a single system whereby control was centralised to the mint within the Tower of London, mints outside of London were reduced with only a few local and episcopals continuing to operate.[9]Pipe rolls detailing the financial records of the London mint show an expenditure of £729 17s 8½d and records of timber bought for workshops.

Individual roles at the mint were well established by 1464. The master-worker was charged with hiring engravers and the management of moneyers, while the mint warden was responsible for witnessing the delivery of dies. A specialist mint board was set up in 1472 to enact a 23 February indenture which vested the mint's responsibilities into three main roles; a warden, a master and a comptroller.

In the 16th century having suffering from the effects of the Black Death, mainland Europe was in the middle of an economic expansion, England however was suffering with financial difficulty brought on by excessive government spending. By the 1540s wars with France and Scotland led Henry VIII to enact The Great Debasement which saw the amount of precious metal in coin significantly reduced.[10] In order to further gather control of the country's currency, monasteries were dissolved which effectively ended major coin production outside of London.

In 1603, the union of Scotland and England under King James VI led to a partial union of both countries' currencies, the pound Scots and the pound sterling. Due to Scotland heavily debasing its silver coins, a Scots mark was worth just 13.5d compared to an English mark which was worth 6s 8d. To bridge the difference between the values, unofficial supplementary token coins, often made from lead were made by unauthorised minters across the country. By 1612 there were 3,000 such unlicensed mints producing these tokens, none of whom paying anything towards the crown. The Royal Mint, not wanting to divert manpower away from minting more profitable gold and silver, hired outside agent Lord Harington who under licence started issuing copper farthings in 1613. Private licenses to mint these coins were revoked in 1644 which led traders to resume minting their own supplementary tokens. In 1672 the Royal Mint finally took over the production of copper coinage.

Civil War mints

Charles I Civil War half-crown

Prior to the outbreak of the English Civil War, England signed a treaty in 1630 with Spain which ensured a steady supply of silver bullion to the Tower mint. Additional branch mints to aid the one in London were set up including one at Aberystwyth Castle, in Wales. In 1642 parliament seized control of the Tower mint and after Charles I tried to arrest the Five Members he was forced to flee London, establishing at least 16 emergency mints across the British Isles in Colchester, Chester, Cork, Edinburgh, Dublin, Exeter, Salisbury, parts of Cornwall including Truro, Weymouth, Worcester, York, Carlisle, Newark, Pontefract and Scarborough (see also siege money).

After raising the royal standard in Nottingham marking the beginning of the war, Charles called upon loyalist mining engineer Thomas Bushell, the owner of a mint and silver mine in Aberystwyth, to move his operations to the royalist-held Shrewsbury, possibly within in the grounds of Shrewsbury Castle. The mint there was however short-lived, operating for no more than three months before Charles ordered Bushell to relocate the mint to his headquarters in the royal capital of Oxford. The new Oxford mint was established on 15 December 1642 in New Inn Hall at Oxford University, the present site of St. Peter's College. There, silver plates and foreign coins were melted down and in some cases just hammered into shape to produce coins quickly. Bushell was appointed the mint's warden and master-worker, where he laboured alongside notable engravers Nicholas Briot, Thomas Rawlins and Nicholas Burghers, the later of whom being appointed Graver of Seals, Stamps and Medals in 1643. When Prince Rupert took control of Oxford that same year, Bushnell was ordered to move to Bristol Castle where he continued minting coins until it fell to parliamentary control on 11 September 1645, effectively ending Bushnell's involvement in the civil war mints.

In Southern England in November 1642 the king ordered royalist MP Richard Vyvyan to build one or more mints in Cornwall where he was instructed to mint coins from whatever bullion that could be obtained and deliver it to Ralph Hopton, a commander of royalist troops in the region. Vyvyan built a mint in Truro and became its Master until 1646 when it was captured by parliamentarians. In nearby Exeter which had been under control of Westminster since the beginning of the war, a mint was ordered to be set up after parliament debated the proposal on 8 December 1642. After approval was granted, a mint and moneyers were dispatched on 8 December 1642 to the town which was under constant threat of attack by loyalist troops. In September 1643 the town was captured by the Cornish Royalist Army led by Prince Maurice leading to Vyvyan moving his nearby mint in Truro to the now recaptured town. The exact location of the mint in Exeter is unknown, however maps from the time show a street named Old Mint Lane near Friernhay which was to be the site of a 1696 Recoinage mint. Much less is known about the mint's employees with only Richard Vyvyan and clerk Thomas Hawkes recorded.[11]

Commonwealth Unite 1653

1658 Cromwell Crown

Following Charles I's execution in 1649, the newly formed Commonwealth of England established its own set of coins which for the first time used English rather than Latin and were plainly designed compared to those previously issued under the monarchy.[12] The government invited French engineer Peter Blondeau who worked at the Paris mint to come to London in 1649 in hope of modernising the country's minting process. In France hammer stuck coins had been banned from the Paris Mint since 1639 and replaced with milled coinage.[13] After arriving, it wasn't until 9 May 1651 that his testing began in Drury House, having first required permission from parliament. He initially produced milled silver pattern pieces of halfcrowns, shillings and sixpences however rival moneyers favouring hammer stuck coins continued using the old hammering method. In 1656 Lord Protector Oliver Cromwell ordered engraver Thomas Simon to cut a series of dies featuring his bust and for them to be minted using the new milled method. Few of Cromwell's coins entered circulation with Cromwell himself dying in 1658 and the Commonwealth collapsing two year later. Without Cromwell's backing of milled coinage, Peter Blondeau returned to France leaving England to continue minting hammer struck coins.

Isaac Newton in 1702

In 1662, after previous attempts to introduce milled coinage into Britain had failed, the restored monarch Charles II recalled Peter Blondeau to establish a permanent machine-made coinage.[14][15] Despite the introduction of the newer, milled coins, like the old hammered coins they suffered heavily from counterfeiting and clipping. To combat this the text Decus et tutamen (An ornament and a safeguard) was added to some coin rims.[16]

Following the Glorious Revolution of 1688, which saw the ousting of James II from power, parliament took over control of the mint from the Crown which had up until then allowed the mint to act as an independent body producing coins on behalf of the government.

Under the patronage of Charles Montagu, 1st Earl of Halifax, Isaac Newton became the mint's warden in 1696. His role, intended to be a sinecure, was taken seriously by Newton, who went about trying to combat the country's growing problems with counterfeiting. By this time, forgeries accounted for 10% of the country's coinage, clipping was commonplace and the value of silver in coins had surpassed their face value. King William III initiated the Great Recoinage of 1696 whereby all coins were removed from circulation and enacted the Coin Act 1696 making it high treason to own or possess counterfeiting equipment. Satellite mints to aid in the re-coinage were established in Bristol, Chester, Exeter, Norwich, and York, with returned coins being valued by weight, not face value.

The Acts of Union 1707 united England and Scotland into one country, leading London to take over production of Scotland's currency and thus replacing Scotland's Pound Scots with the English Pound Sterling which caused the Edinburgh mint to eventually close on 4 August 1710. As Britain's empire continued to expand, so to was the need to supply its coinage. This along with the need for new mint machinery and cramped conditions within the Tower of London, led to plans for the mint to move to nearby East Smithfield.

1805 to 1967

Tower Hill

Johnson Smirke Building in 2007

Located opposite from the Tower of London on Tower Hill, the new purpose-built mint began construction in 1805 and was completed by 1809. However it was not until 1812 that the move became official, when keys from the old mint were ceremoniously delivered to the Constable of the Tower.[17] Facing the front of the site stood the Johnson Smirke Building whose namesake comes from its designer James Johnson and builder Robert Smirke. This building was flanked on both sides by gatehouses behind which another building housed the mint's new machinery. A number of other smaller buildings were also erected which housed mint officers and staff members. The entire site was protected by a boundary wall which was patrolled by the Royal Mint's military guard.

By 1856, the mint was beginning to prove inefficient, suffering from irregularities in minted coins' fineness and weight. Instructed by Prime Minister Lord Palmerston, the Master of the Mint Thomas Graham was informed that unless the mint could raise its standards and become more economical it would be broken up and placed under management by contractors. Graham sought advice from German chemist August Wilhelm von Hofmann who in turn recommended his student George Frederick Ansell as being able to resolve the mint's issues. In a letter to the treasury dated 29 October 1856, Ansell was put forward as candidate and subsequently was awarded the role of temporary clerk on 12 November 1856 with a £120 a year salary.[18]

Upon taking office, Ansell discovered that the weighing of metals at the mint was extremely loose. At the mint it had been the custom to weigh silver to within 0.5 ounces and gold to a pennyweight (0.05 ounces), however these standards meant losses were being made from overvalued metals. In one such case Ansell delivered 7920.00 ounces of gold to the mint where it was weighed by an official at 7918.15 ounces, a difference of 1.85 ounces. Requesting a second weighing on more accurate scale, the bullion was certified to weigh 7919.98 ounces, far closer to the previous measurement which was off by 960 grains. To increase the accuracy of weights, more precise weighing equipment was ordered and specifications were revised to 0.10 ounce for silver and gold to 0.01oz. Between 1856 and 1866 the old scales were gradually removed and replaced with ones made by Messrs. De Grave, Short, and Fanner; winners of a 1862 International Exhibition prize award for work relating to balances.[18]

Another observation Ansell made was the loss of gold during the manufacturing process. He found that 15-20 ounces could be recovered through the sweep, that is the leftover burnt rubbish from the minting process which was often left in open boxes for many months before being removed. Wanting to account for every particle, he hypothesised that because the Conservation of mass meant it was physically impossible for gold to just disappear he put down the lost weight to a combination of oil, dust and different types of foreign matter amongst the gold.

In 1859, the Royal Mint rejected a batch of gold that was found to be too brittle for the minting of gold sovereigns. Analysis revealed the presence of small amounts of antimony, arsenic and lead. With Ansell's background in chemistry, he persuaded the Royal Mint to allow him to experiment with the alloy and was ultimately able to produce 167,539 gold sovereigns.[19] On a second occasion in 1868, it was again discovered that gold coins, this time totalling £500,000 worth, were being produced with inferior gold. Although the standard practise at the mint was for rejected coins (known as brockages) to be melted down, many entered general circulation and the mint was forced to return thousands of ounces of gold to the Bank of England. Although Ansell offered to re-melt the substandard coins, his offer was rejected causing a row between him and senior mint chiefs which ultimately led to him being removed from his position at the mint.[20]

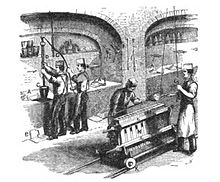

Gold Melting Process (1870)

Royal Mint Refinery

After relocating to its new home on Tower Hill, the Mint came under increased scrutiny of how it dealt with unrefined gold that had entered the country. Initially the Master of the Mint was responsible for overseeing the practise since the position's inception in the 1300s, however the refinery process proved too costly and suffered from a lack of accountability from the master. A Royal Commission later set up in 1848 to address these issues gave recommendation for the refinery process to be outsourced to another external agency thereby removing the refining process from the mint's responsibilities. The opportunity to handle in Mint's refinery was taken up by Anthony de Rothschild, a descendant of the Rothschild family and heir to the multinational investment banking company N M Rothschild & Sons. Rothschild secured a lease from the government in January 1852, purchasing equipment and a premise adjacent to the Royal Mint on 19 Royal Mint Street under the name of Royal Mint Refinery.

Colonial Expansion

Royal Mint, Sydney in 1888

As Britain's influence as a world power expanded, with colonies being established abroad, a greater need for currency led to the Royal Mint opening satellite branches of itself overseas. In Australia, the local Legislative Council petitioned the UK government to establish a branch of the Royal Mint in Sydney (Sydney Mint) after prospector Edward Hargraves discovered gold in Ophir, New South Wales in 1851. The petitioned gain royal assent in 1853 and plans were made by the Deputy Master of the Royal Mint in London to open the Royal Mint's first overseas branch within the colony. The Royal Mint's Superintendent of Coining travelled to Australia to oversee its establishment on Macquarie Street within the southern wing of Sydney Hospital where it opened in 1854. Its success led to the opening of Melbourne Mint on 2 June 1872 which cost £368,350 and Perth Mint which opened on 20 June 1899. In 1926 after operating for 72 years, the Sydney Mint closed due to its inferior technology and capabilities being superseded by those in Melbourne and Perth. After Australia was federalised in 1901, Great Britain continued to own the mints to as late as 1 July 1970, when they became statutory authorities of the Government of Western Australia.

In Canada, which had been under British rule since 1763, British coins circulated alongside those of other nations until 1858 when London started producing coins for the newly established Canadian dollar. As Canada developed, in 1890 calls were made for a mint to be built in Ottawa to facilitate the country's gold mines. The new mint opened on 2 January 1908 by Lord Grey producing coins for circulation including Ottawa Mint sovereigns. In 1931 under the Statute of Westminster, the mint came under the control on the Government of Canada and subsequently renamed the Royal Canadian Mint.[21]

Hong Kong silver dollar (1867)

A fifth branch of the Royal Mint was established in Mumbai (Bombay), India on 21 December 1917 as part of a wartime effort. It struck sovereign from 15 Aug 1918 til 22 Apr 1919. before closing in May 1919.[22][23] A sixth and final overseas mint was established in the Union of South Africa in Pretoria on 1 January 1923, producing £83,114,575 worth of sovereigns of its lifetime. As South Africa began cutting ties with Britain, the mint closed on 30 June 1941 only to be later reopened as the South African Mint.[24]

Although just six mints were officially controlled by London's Royal Mint, many more independent mints were set up to facilitate parts of the British Empire. In New Westminster, British Columbia the British Columbia gold rushes led to a mint being set up in 1862 under Governor James Douglas where it produced a few gold and silver coins before being shut down in 1862 to aid the city of Victoria in becoming the regions provincial capital.[25] On 26 February 1864 an Order of Council requested for the founding of independent mint (Hong Kong Mint) in British Hong Kong to issue silver and bronze coins.[26][27] This mint was short lived however due to its coins being heavy debasement causing significant losses. The site was sold to Jardine Matheson in 1868 and the mint machinery sold to the Japanese Mint in Osaka.[28]

New Zealand's $1 and $2 coins are minted by the Royal Mint in the United Kingdom. The 10 cent, 20 cent and 50 cent coins are minted by the Royal Canadian Mint. Other mints the Bank has used over time include: the Royal Australian Mint, Norwegian Mint and the South African Mint Company. The F4 Coin mintings data has details about the number and value of coin mintages.[29]

1914 to 1967

In 1914 as war broke out in Europe, Chancellor of the Exchequer David Lloyd George instructed for gold coins to be removed from circulation so as to help pay for the war effort. The government started to issue £1 and 10 shilling treasury notes as replacement paving the way for Britain leaving the gold standard in 1931.

Engraving room at the Royal Mint in 1934

From 1928, the Irish Free State (later Republic of Ireland) issued its own coins. These were produced by the Royal Mint until Ireland established its own Currency Centre in Dublin in 1978.

During World War II the Mint played an important role in ensuring that people were paid for their services with hard currency rather than banknotes. Under Operation Bernhard, the Nazis planned to collapse the British economy by flooding the country with forged notes leading the Bank of England to stop issuing banknotes of £10 and above. To meet these demands the Mint doubled its output so that by 1943 it was minting around 700 million coins a year despite being under constant threat of being bombed. The Deputy Master of the Mint John Craig recognised the dangers to the Mint, introduced a number of measures to ensure the Mint could continue to operate in the event of a disaster. Craig added emergency water supplies, reinforced the Mint's basement to act as an air-raid shelter and even accepted employment of women for the first time. For most of the war the mint managed to escape the destruction of the Blitz until December 1940 when three members of staff were killed in an air-raid. Around the same time an auxiliary mint was set up at Pinewood Studios which had been requisitioned for the war effort. Staff and machinery from Tower Hill were moved to the site in Buckinghamshire where it started production in June 1941 and operated for the duration of the war.[30][31] Over the course of the war the Royal Mint was hit on several different occasions and at one point was put out of commission for three weeks. As technology changed with the introduction of electricity and demand continuing to grow, the process of rebuilding continued so that by the 1960s little of the original mint remained, apart from Smirke's 1809 building and its gatehouses at the front.

On 1 March 1966 the government announced its intention for the pound to be decimalised which would require a large-scale withdrawal and minting of millions of new coins, this, as well as commitments to overseas customers, meant the mint was to be faced with a heavy workload. Lack of space at the mint and with Decimal Day looming it became apparent that the mint needed to again relocate to a larger site. With a degree of urgency plans were made in April 1967 for a new site to be built outside of London, although over twenty sites were considered[32] the small Welsh town of Llantrisant located ten miles (16 km) north-west of Cardiff was chosen[33] Up until now improvements at the Tower Hill mint had cost £800,000.[citation needed]

1967 to present

Move to Wales

Royal Mint in Llantrisant

Work on the new mint began in August 1967 with the construction of a blank treatment plant and plant for striking. This first phase of the mint was officially opened on 17 December 1968 by the royal attendance of Queen Elizabeth II, Prince Philip and their son Prince Charles. Originally there were fears that the Royal family would face protests because of the Investiture of Prince Charles as the Prince of Wales; however, such protests failed to materialise.[34] The second phase of construction began in 1973 and included the addition of a means to mint coins from virgin metals completing the full minting process. Upon completion the final cost for the land, buildings and plant came to £8 million.[35] Coin minting and production gradually shifted to the new site over the next seven years until the last coin, a gold sovereign, was struck in London in November 1975. In an attempt to consolidate all previous coin-related acts, the Coinage Act of 1971 was passed, which among other things effectively abolished the individual role of Master of the Mint. Under this act, the Chancellor of the Exchequer took over the role, with a Deputy Master being appointed by the Treasury to exercise all the powers and duties of the Master within the mint.

Financial Difficulties

After moving to Wales, the mint struggled to become profitable as the Western world fell into a deep recession during the early 1970s. To combat a rising national debt, the mint was established as a trading fund on 1 April 1975 which required it to become self-financing. This measure proved successful and the mint started to become profitable through heavy exports.To allow for more financial freedom and better management the mint became an Executive Agency in April 1990.[36]

During the 2008 global financial crisis, a rescue package costing £500 billion was announced to help stabilise Britain's banking system. This led to fear that the government would attempt to finance the cost by selling off state-owned organisations. In a 2009 pre-budget report the Chancellor of the Exchequer, Alistair Darling stated that the treasury would "explore the potential benefits of alternative future models for the Royal Mint".[37][38] A month later in his 2009 United Kingdom budget he recommended that the mint be made a company with a view of it being sold.[39] The decision was met with outrage by unions and opposition parties in parliament who called it the "selling off the family silver" and that it would result in jobs losses. In contrast, the chief executive of the mint Andrew Stafford welcomed the decision stating that it would lead to further growth and secure the future of the business.[40] On 31 December 2009, rather than being fully privatised, the mint ceased to be an executive agency and its assets vested in a limited company, Royal Mint Ltd. The owner of the new company became The Royal Mint trading fund, which itself continued to be owned by HM Treasury. As its sole shareholder the mint pays an annual dividend of £4 million to treasury with the remaining profits being reinvested into the mint.[41] In 2015 Chancellor of the Exchequer George Osborne announced a £20 billion privatisation drive to raise funds with the Royal Mint being up for sale alongside other institutions including the Met Office and Companies House.[38]

Revival

With its new found financial freedom the Mint begun diversifying their product range through expanding to offer items outside their usual coin-related merchandise. By the early 2000s the Mint was selling different types of jewellery, commemorative plates and figurines,[42] eventually creating its own Royal Mint Classics range of collectable goods. This part of the business proved popular in attracting new customers however suffered from poor product development. Example of its products included a hip flask with an embedded £2 coin, an Edinburgh Crystal clock combined with a millennium Crown, and a Wedgwood plate featuring Britannia.[43] In 2007 the Mint decided to resume its focus on coins, downsizing non-coin related business and discontinuing its Classics range.[44]

2012 London Olympics

2012 Olympic Medal made by the Mint

After London was selected to host the 2012 Summer Olympic Games, the Royal Mint successfully won its bid to manufacture the games' Olympic and Paralympic medals.[45] 4,700 gold, sliver and bronze medals were produced by the Mint with each medal being struck 15 times with 900 tonnes of force.[46]

| Olympic Medal Specifications[46][47] | |||

|---|---|---|---|

| Gold Medal | Silver Medal | Bronze Medal | |

| Weight | 412g | 412g | 357g |

| Composition | 1.34% Gold 93% Silver 6% Copper | 93% Silver 7% Copper | 97% Copper 2.5% Zinc 0.5% Tin |

In addition to securing the medal product contract, the mint held a competition to design a series of commemorative fifty pence coins that would enter general circulation prior to the event. The Mint received over 30,000 entries with a further 17,000 from a children's competition on Blue Peter. In all, a total of 29 designs featuring a sport were selected by the Mint, with the youngest designer being just 9 years old.[48] A £2 coin commemorating London's handover to Rio was also released in 2012.

The Royal Mint Experience

In April 2014 the mint announced plans for the development of a visitor centre in Llantrisant where members of the public could take part in a guided tour of the facility and learn about the mint's history. The development's contract, estimated to be worth £7.7 million was awarded to construction firm ISG and design consultant Mather & Co who had previously designed the Norwegian Olympic Museum, as well as a handful of visitor attractions for sporting clubs including Chelsea F.C, Manchester City F.C, FC Porto and the Springboks.[49][50] To fund the development, a grant of £2.3 million was provided by the Welsh Government towards the attraction which aimed to attract 200,000 visitors a year to the area.[51] By May 2016, two years after its announcement the now named Royal Mint Experience opened to the public at a final cost of £9 million. Included in the visitor centre an interactive museum, a view onto the factory floor, an education centre and a press whereby visitors can strike their own souvenir £1 coin.[52][53] On display at the centre are more than 80,000 artefacts,[54] including Olympic medals, a pattern coin of Edward VIII, a Janvier reducing machine and a selection of trial plates.

Recent Events

In the same month the mint took in 48 tonnes of silver recovered from the shipwreck of the SS Gairsoppa which was used to produce limited edition coins.[55]

In 2015, after nearly 50 years, the mint began producing its own line of bullion bars and coins under its revived Royal Mint Refinery brand. Then in 2016, the mint announced plans for Royal Mint Gold (RMG), a digital gold currency that uses blockchain to trade and invest in gold. Operated by CME Group, the technology is to be created by technology companies AlphaPoint and BitGo.[56] The system currency which was due to launch in 2017 will be on the gold standard, whereby one RMG token equates to 1 gram of physical gold held within in a Royal Mint vault. Up to $1 billion worth of RMG is set to be issued by the mint.[57]

Operations

Coin production

As the sole body responsible for minting legal tender coins in the United Kingdom under contract from HM Treasury, the mint produces all of the country's physical currency apart from banknotes which are printed by the Bank of England. On average it produces 2 billion pound sterling coins struck for general circulation every year with an estimated 28 billion pieces circulating altogether. Outside of the UK, the mint provides services to over 60 different countries including New Zealand and many Caribbean nations in the form of producing national currencies or supplying ready to strike planchets.[3] In 2015 it was estimated that 2.4 billion coins were minted for overseas countries outweighing that of domestic coinage and providing over 60% of the mint's revenue from circulating currencies. The sale of commemorative coins also form part of the mint's operations with coins of varying quality and made of different precious metals released yearly for the collector's market.

| Coins minted (billion) | |||

|---|---|---|---|

| 2015[58] | 2014[58] | 2013[59] | |

| United Kingdom | 2.007 | 2.384 | 1.996 |

| International | 2.4 | 2.2 | 2.0 |

Bullion

Royal Mint Refinery Seal

Another important operation performed by the mint which contributes to half the mint's revenue is the sale of bullion to investors or general members of the public in the form of bars or coins. Historically the mint has refined its own metal, however under the advice of an 1848 Royal Commission the process was separated with the independent Royal Mint Refinery being purchased and operated by Anthony de Rothschild in 1852. The Rothschild family continued the refinery's management until it was sold to Engelhard in 1967, a year later the Royal Mint relocated to Wales and ceased their bullion bar interests until reviving the brand in 2015. Bullion bars produced by the mint are stamped with the original Royal Mint Refinery emblem and come in a range of different sizes.[60]

| Bullion bars | ||||||||

|---|---|---|---|---|---|---|---|---|

| Metal | Fineness | Weights | ||||||

Silver | 999 | n/a | 100g | 500g | 1 kg | |||

Gold | 999.9 | 1g | 5g | 10g | 1oz | 100g | 500g | 1 kg |

Platinum | 999.5 | n/a | 1oz | 100g | 500g | 1 kg | ||

Minting of bullion coins began in 1957 to meet a demand for authentic sovereign coins which suffered from heavy counterfeiting. Coins were released almost every year alongside proof versions up to 1982 when production was discontinued. In 1987 the mint started to produce a new type of bullion coin, the 1oz Britannia coin which was gold and had a face value of £100. A silver version with a face value of £2 was also released in 1997. Production of the previously discontinued sovereign and half sovereigns resumed in 2000. In 2014 a lunar coin series begun being minted annually in celebration of Lunar New Year and in 2016 a series featuring The Queen's Beasts began.

| Bullion coins | ||||||

|---|---|---|---|---|---|---|

| Type | Face Value | Diameter | Weight | Fineness | Ref. | |

Britannia | One Ounce Silver | £2 | 38.61mm | 31.21g | 999 | |

| One Ounce Gold | £100 | 32.69mm | 31.21g | 999.9 | [61] | |

Sovereign | Sovereign | £1 | 22.05mm | 7.988g | .916 | [62] |

Queen's Beasts | Two Ounce Silver | £5 | 38.61mm | 62.42g | 999 | [63] |

| One Ounce Gold | £100 | 32.69mm | 31.21g | 999.9 | ||

| One Ounce Platinum | £100 | 32.69mm | 31.21g | 999.5 | ||

Lunar Series | One Ounce Silver | £2 | 38.61mm | 31.21g | 999 | [64] |

| One Ounce Gold | £100 | 32.69mm | 31.21g | 999.9 | ||

Landmarks of Britain | One Ounce Silver | £2 | 38.61mm | 31.21g | 999 | [65] |

Medals

On occasion, the mint produces medals for government departments and under private contract for clients such as Royal societies, colleges and universities. Most notably the mint has made OBE medals as well as many military honours including the Defence Medal and the Conspicuous Gallantry Cross for the British Armed Forces.[66] For the 2012 Summer Olympics the mint won a contract to produce 4,700 gold, silver and bronze medals for competitors.[67]

Prior to 1851, the making of medals at the mint was at the discretion of engravers who could undertake the work independently and receive and additional wage. A Royal patent which was issued in 1669 granted the mint the sole right to produce medals of any metal which bore a portrait of a monarch. Engravers would use the facilities at the mint to make commemorative medals to their own design for sale. A key date in the mint's history of producing medals for the military is 1815 when the Battle of Waterloo marked the beginning of awarding military campaign medals. By 1874 the mint was responsible for making all bars and clasps for war medals in the country and was making campaign medals such as the New Zealand Medal, the Abyssinian War Medal and the Ashantee Medal.[68]

At the start of the First World War, military medals were manufactured by the Woolwich Arsenal and private contractors, however in 1922 a new medal unit created by the mint became the sole manufacturer of all Royal and State medals and decorations in metal, except the Victoria Cross which is made by Hancocks & Co.[68][69] Prior to 2010, all British military medals were made by the mint however now must compete with other manufacturers.[citation needed]

Waterloo Medal (1849)

2012 Summer Olympics

Military Cross

George Cross

Arctic Star

Trial of the Pyx

The Trial of the Pyx is the procedure in the United Kingdom for ensuring that newly-minted coins conform to required standards. The trials have been held since the twelfth century, normally once per calendar year, and continue to the present day. The form of the ceremony has been essentially the same since 1282. They are trials in the full judicial sense, presided over by a judge with an expert jury of assayers. Since 1871, the trials have taken place at the Hall of the Worshipful Company of Goldsmiths, having previously taken place at the Palace of Westminster.[70] Given modern production methods, it is unlikely that coins would not conform, although this has been a problem in the past as it would have been tempting for the Master of the Mint to steal precious metals.

The term "Pyx" refers to the boxwood chest (in Greek, πυξίς, pyxis) in which coins were placed for presentation to the jury. There is also a Pyx Chapel (or Pyx Chamber) in Westminster Abbey, which was once used for secure storage of the Pyx and related articles.

Coins to be tested are drawn from the regular production of The Royal Mint. The Deputy Master of the Mint must, throughout the year, randomly select several thousand sample coins and place them aside for the Trial. These must be in a certain fixed proportion to the number of coins produced. For example, for every 5,000 bimetallic coins issued, one must be set aside, but for silver Maundy money the proportion is one in 150.

The trial today consists of an inquiry independent of the royal mint[71]

The jury is composed of Freemen of the Company of Goldsmiths, who assay the coins provided to decide whether they have been minted within the criteria determined by the relevant Coinage Acts.[72]

See also

- List of British banknotes and coins

- Coins of the pound sterling

- Banknotes of the pound sterling

- George Frederick Ansell

- William John Hocking

- Joseph Harris (British astronomer)

- List of Mints

- Mints of Scotland

- Kevin Clancy

References

^ "Chief Executive". The Royal Mint. Retrieved 4 January 2018..mw-parser-output cite.citation{font-style:inherit}.mw-parser-output .citation q{quotes:"""""""'""'"}.mw-parser-output .citation .cs1-lock-free a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/6/65/Lock-green.svg/9px-Lock-green.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-limited a,.mw-parser-output .citation .cs1-lock-registration a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/d/d6/Lock-gray-alt-2.svg/9px-Lock-gray-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-subscription a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/a/aa/Lock-red-alt-2.svg/9px-Lock-red-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration{color:#555}.mw-parser-output .cs1-subscription span,.mw-parser-output .cs1-registration span{border-bottom:1px dotted;cursor:help}.mw-parser-output .cs1-ws-icon a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/4/4c/Wikisource-logo.svg/12px-Wikisource-logo.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output code.cs1-code{color:inherit;background:inherit;border:inherit;padding:inherit}.mw-parser-output .cs1-hidden-error{display:none;font-size:100%}.mw-parser-output .cs1-visible-error{font-size:100%}.mw-parser-output .cs1-maint{display:none;color:#33aa33;margin-left:0.3em}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration,.mw-parser-output .cs1-format{font-size:95%}.mw-parser-output .cs1-kern-left,.mw-parser-output .cs1-kern-wl-left{padding-left:0.2em}.mw-parser-output .cs1-kern-right,.mw-parser-output .cs1-kern-wl-right{padding-right:0.2em}

^ abcd "The Royal Mint Limited Consolidated Annual Report 2016–17" (PDF). Royal Mint. Retrieved 8 December 2017.

^ ab "About The Royal Mint". The Royal Mint. 25 August 2015. Retrieved 25 August 2015.

^ "Factory of the month: The Royal Mint". themanufacturer.com. 7 December 2012. Retrieved 13 June 2017.

^ Rudd, Chris. "Britain's First Coins". Retrieved 6 June 2017.

^ "The Royal Mint Story". Royal Mint. Retrieved 25 May 2017.

^ Dyer 1986, p. 3.

^ "The Royal Mint". Museums Victoria. Retrieved 6 June 2017.

^ "Records of the Royal Mint". The National Archive. Retrieved 6 June 2017.

^ "The Testoons of Henry VIII". AMR Coins. Retrieved 2 April 2017.

^ Morgns, Geraint (December 1999). "Making a Mint?". Country Quest. Archived from the original on 2012-08-31. Retrieved 17 July 2017.

^ Julian, R.W. (23 January 2017). "Cromwell Put is Portrait on Coins". numismaster.com. Retrieved 17 July 2017.

^ Allen 2009, p. 282.

^ Linecar (1985), pp. 88–98.

^ Glyn 2010, p. 888.

^ Great Britain. Treasury. Information Division (1986). Economic Progress Report. Information Division of the Treasury.

^ "Tower Hill". Royal Mint. Retrieved 28 April 2017.

^ ab Ansell 1870.

^ "1859 'Ansell' Sovereign". Archived from the original on 15 February 2016. Retrieved 8 February 2016.

^ W. P. Courtney, rev. Robert Brown, "Ansell, George Frederick (1826–1880)", Oxford Dictionary of National Biography, Oxford University Press, 2004. Accessed 10 February 2017.

^ "Ontario's Historical Plaques". ontarioplaques.com. Retrieved 2 July 2017.

^ Michael 2016, p. 1130.

^ "The History of the Indian Sovereign". goldsovereign.in. Retrieved 22 July 2017.

^ "The History of the South African Mint". southcapecoins.co.za. Retrieved 22 July 2017.

^ Hainsworth 2005, p. 148.

^ "Hong Kong Currency". Leisure and Cultural Services Department. Retrieved 22 July 2017.

^ "Royal Mint: Branch Mints". The National Archives. Retrieved 22 July 2017.

^ Ingham 2007, p. 70.

^ "The history of coins in New Zealand". Reserve Bank of New Zealand. Retrieved 22 July 2017.

^ Beardon 2013, p. 177.

^ Challis 1992, p. 579.

^ Pearson, Arthur (26 March 1970). "Royal Mint". Hansard. Archived from the original on 2009-07-17. Retrieved 28 April 2017.

^ "A New Royal Mint". The Royal Mint. Retrieved 28 April 2017.

^ Queen Opens New Mint (1968). Pathé News. Retrieved 28 April 2017.

^ Taverne, Dick (17 March 1970). "Royal Mint (Move)". Hansard. Archived from the original on 2009-07-17. Retrieved 28 April 2017.

^ "HC Deb 02 April 1990 vol 170 cc390-1W". Hansard. Archived from the original on 2009-07-10. Retrieved 30 May 2017.

^ Blake, Aled (17 March 2009). "Privatisation of Royal Mint at Llantrisant rolls closer". Wales Online. Retrieved 3 June 2017.

^ ab Pickard, Plimmer, Jim, Gill (11 September 2016). "Green Investment Bank bidders ready final offer". Financial Times. Retrieved 3 June 2017.

^ Bawden, Anna (22 April 2009). "Budget 2009: Thousands of public sector jobs at risk". The Guardian. Retrieved 22 April 2017.

^ "Royal Mint privatisation closer". BBC News. 21 April 2009. Retrieved 2 June 2017.

^ Kollewe, Julia (24 July 2015). "Royal Mint Makes a Mint … Again". The Guardian. Retrieved 2 June 2017.

^ "Royal Mint Annual Report 2001-02" (PDF). Royal Mint. Archived from the original (PDF) on 2017-06-13. Retrieved 1 July 2017.

^ "Royal Mint Annual Report 1999 -2000" (PDF). Royal Mint. Archived from the original (PDF) on 2016-03-31. Retrieved 1 July 2017.

^ "The Royal Mint Annual Report 2007-08" (PDF). Royal Mint. Archived from the original (PDF) on 2016-03-30. Retrieved 1 July 2017.

^ Ruddick, Graham (16 December 2017). "London 2012 Olympics: Royal Mint wins contract to make medals". The Daily Telegraph. Retrieved 2 July 2017.

^ ab Hume, Colette (27 October 2011). "London 2012: Olympic medals go into production in Wales". BBC News. Retrieved 2 July 2017.

^ DeMarco, Anthony (26 July 2012). "London's Olympic Gold Medal Worth The Most In The History Of The Games". Forbes. Retrieved 2 July 2017.

^ "London 2012 Olympic 50p coins go into circulation". BBC. Retrieved 1 July 2017.

^ Barry, Sion (13 April 2015). "The Royal Mint appoints design consultancy for its £7.5m interactive museum". Wales Online. Retrieved 6 July 2017.

^ "Mather & Co - Our Work". matherandco.com. Retrieved 6 July 2017.

^ "The Royal Mint announces plans for first visitor centre". The Royal Mint. 24 April 2014. Retrieved 28 April 2017.

^ Doran, Lorna (17 May 2016). "Everything you need to know about The Royal Mint Experience". Wales Online. Retrieved 28 April 2017.

^ Boyce, Lee (31 January 2017). "Ever wondered how your coins are made? LEE BOYCE takes a trip to the Royal Mint in Wales to find out (and discovers they are actually pickled...)". This is Money. Retrieved 28 April 2017.

^ Montgomery, Angus (17 November 2014). "Royal Mint seeks exhibition designers as visitor centre plans take shape". Design Week 30. Retrieved 6 July 2017.

^ Evans, Carrie (4 April 2014). "Royal Mint takes delivery of 48 tonnes of silver salvaged from site of WWII shipwreck". Wales Online. Retrieved 7 June 2017.

^ Anna, Irrera (11 April 2017). "CME Group, Royal Mint test blockchain-based gold trading platform". Reuters. Retrieved 13 June 2017.

^ Castor, Amy (23 May 2017). "Consensus 2017: CME Group, UK Royal Mint Detail Plans for Blockchain Gold". CoinDesk. Retrieved 13 June 2017.

^ ab "The Royal Mint Limited Annual Report 2015-16" (PDF). The Royal Mint. Archived from the original (PDF) on 2017-06-13. Retrieved 30 April 2017.

^ "The Royal Mint Limited Annual Report 2014-15" (PDF). The Royal Mint. Archived from the original (PDF) on 2017-06-13. Retrieved 30 April 2017.

^ Oliver, Dan (21 January 2015). "Gold bars now available from The Royal Mint". The Royal Mint. Retrieved 29 April 2017.

^ "Gold Britannias Index Page". taxfreegold.co.uk. Retrieved 30 April 2017.

^ "British Gold Sovereigns - Information". taxfreegold.co.uk. Retrieved 30 April 2017.

^ "British Queen's Beasts Coin Series". taxfreegold.co.uk. Retrieved 30 April 2017.

^ "British Chinese Lunar Calendar Coins". taxfreegold.co.uk. Retrieved 30 April 2017.

^ "Landmarks Of Britain Silver Coins". Royal Mint Bullion. Retrieved 21 September 2017.

^ "A badge of honour – our pride in making medals at The Royal Mint". Royal Mint Blog. Retrieved 24 September 2017.

^ Ruddick, Graham (16 December 2010). "London 2012 Olympics: Royal Mint wins contract to make medals". The Telegraph. Retrieved 30 April 2017.

^ ab "Royal Mint: Medals". The National Archive. Retrieved 24 September 2017.

^ "Victoria Cross". hancocks-london.com. Archived from the original on 2017-09-24. Retrieved 20 April 2017.

^ "The Trial of the Pyx". The Goldsmiths' Company. The Goldsmiths' Company. 2004. Retrieved 2 September 2008.

^ "Trial of the Pyx". Royal Mint Museum. Retrieved 25 September 2017.

^ "The History of the Trial of the Pyx". The Royal Mint. 27 March 2012. Retrieved 27 March 2012.

Bibliography

.mw-parser-output .refbegin{font-size:90%;margin-bottom:0.5em}.mw-parser-output .refbegin-hanging-indents>ul{list-style-type:none;margin-left:0}.mw-parser-output .refbegin-hanging-indents>ul>li,.mw-parser-output .refbegin-hanging-indents>dl>dd{margin-left:0;padding-left:3.2em;text-indent:-3.2em;list-style:none}.mw-parser-output .refbegin-100{font-size:100%}

Allen, Larry (2009). The Encyclopedia of Money. ABC-CLIO. ISBN 978-1598842517.

Ansell, George Frederick (1870). The Royal Mint: its working, conduct, and operations... London: Effingham Wilson, Royal Exchange.

Beardon, James (2013). The Spellmount Guide to London in the Second World War. Spellmount. p. 177.

Challis, C. E. (1992). A New History of the Royal Mint. Cambridge University Press.

Craig, John (2011). The Mint: A History of the London Mint from A.D. 287 to 1948. Cambridge University Press.

Davis, Glyn (2010). A History of Money From Ancient Times to the Present Day. University of Wales Press. ISBN 978-0708317174.

Dyer, G.P. (1986). The Royal Mint : An Illustrated History. Royal Mint. ISBN 9781869917012.

Hainsworth, Gavin (2005). New Westminster Album: Glimpses of the City as It Was. Dundurn Group Ltd. p. 148. ISBN 978-1550025484.

Ingham, Michael (2007). Hong Kong: A Cultural History. Oxford University Press. p. 70. ISBN 978-0-19-972447-5.

Linecar, Howard (1985). Coins and Coin Collecting. Littlehampton Book Services Ltd. ISBN 9780600500872.

Michael, Thomas (2016). 2017 Standard Catalog of World Coins, 1901-2000. Krause Publications. ISBN 1440246548.

Vince, Alan (2001). Lapidge, Michael; Blair, John; Keynes, Simon; Scragg, Donald, eds. London. The Blackwell Encyclopedia of Anglo-Saxon England. Blackwell. ISBN 978-0-631-22492-1.CS1 maint: Uses editors parameter (link)

External links

- The Royal Mint – official website

- The Royal Mint – official blog

- The Royal Mint – Facebook

- The Royal Mint – Twitter

- The Royal Mint – Instagram

- The Royal Mint – Pinterest

- The Royal Mint – Google Plus

- The Royal Mint Museum

- Coins minted by the Royal Mint

Coordinates: 51°33′15″N 3°23′20″W / 51.5542°N 3.3889°W / 51.5542; -3.3889