Federal Insurance Contributions Act tax

| This article is part of a series on |

| Taxation in the United States of America |

|---|

|

Federal taxation

|

State and local taxation

|

Federal tax reform

|

The Federal Insurance Contributions Act (FICA /ˈfaɪkə/) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare[1]—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

Contents

1 Calculation

1.1 Overview

1.2 Regularly employed people

1.3 Self-employed people

2 Exemptions

2.1 Exemption for some students

2.2 Exemption for employees of some state governments and local governments

2.3 Exemption for certain payments by Native Americans, Native Americans tribal governments, and Native Americans entities

2.4 Exemption for some nonresident aliens

2.5 Exemption for members of some religious groups

2.6 Exemption for some aliens on temporary work assignment

2.7 Exemption for some family employees

2.8 Exemption for foreign governments and some international organizations

2.9 Exemption for services performed by certain individuals hired to be relieved from unemployment

2.10 Exemption for services performed by inmates

2.11 Exemption for services performed by patients

2.12 Exemption for certain emergency workers

2.13 Exemption for certain newspaper carriers

2.14 Exemption for some real estate agents and salespeople

3 History

4 Criticism

5 See also

6 Notes

7 References

8 External links

Calculation

Overview

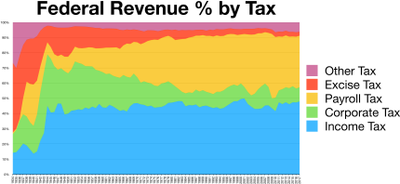

Share of federal revenue from different tax sources. Individual income taxes (blue), payroll taxes/FICA (green), corporate income taxes (red).[2]

Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree.[3] Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life.[4] FICA provides funds to the health care system for institutions that provide healthcare for workers that do not have health insurance and cannot afford healthcare treatment. The United States Supreme Court decided in Flemming v. Nestor (1960) that no one has an accrued property right to benefits from social security. The Federal Insurance Contributions Act is currently codified at Title 26, Subtitle C, Chapter 21 of the United States Code.[5]

In 2004, the Center on Budget and Policy Priorities stated that three-quarters of taxpayers pay more in payroll taxes than they do in income taxes.[6] The FICA tax is considered a regressive tax on income with no standard deduction or personal exemption deduction. The Social Security portion of the tax is imposed on the first $117,000 in 2014, $118,500 in 2015 and 2016, $127,200 in 2017, and $128,400 in 2018.[7] The FICA tax is not imposed on investment income such as rental income, interest, or dividends.

Regularly employed people

Since 1990, the employee's share of the Social Security portion of the FICA tax has been 6.2% of gross compensation up to a limit that adjusts with inflation.[a][8] The taxation limit in 2017 was $127,200 of gross compensation, resulting in a maximum Social Security tax for 2017 of $7,886.40.[7] This limit, known as the Social Security Wage Base, goes up each year based on average national wages and, in general, at a faster rate than the Consumer Price Index (CPI-U). The employee's share of the Medicare portion of the tax is 1.45% of wages, with no limit on the amount of wages subject to the Medicare portion of the tax.[8] Because some payroll compensation may be subject to federal and state income tax withholding in addition to Social Security tax withholding and Medicare tax withholding, the Social Security and Medicare taxes often account for only a portion of the total an employee pays.

The employer is also liable for 6.2% Social Security and 1.45% Medicare taxes,[9] making the total Social Security tax 12.4% of wages and the total Medicare tax 2.9%. (Self-employed people are responsible for the entire FICA percentage of 15.3% (= 12.4% + 2.9%), since they are in a sense both the employer and the employed; see the section on self-employed people for more details.)

| Employee's share of the Social Security portion of the FICA tax[10] | |||

|---|---|---|---|

| Year | Rate | Compensation Limit | Maximum Tax |

| 2005 | 6.2% | $90,000 | $5,580.00 |

| 2006 | 6.2% | $94,200 | $5,840.40 |

| 2007 | 6.2% | $97,500 | $6,045.00 |

| 2008 | 6.2% | $102,000 | $6,324.00 |

| 2009 | 6.2% | $106,800 | $6,621.60 |

| 2010 | 6.2% | $106,800 | $6,621.60 |

| 2011 | 4.2% | $106,800 | $4,485.60 |

| 2012 | 4.2% | $110,100 | $4,624.20 |

| 2013 | 6.2% | $113,700 | $7,049.40 |

| 2014 | 6.2% | $117,000 | $7,254.00 |

| 2015 | 6.2% | $118,500 | $7,347.00 |

| 2016 | 6.2% | $118,500 | $7,347.00 |

| 2017 | 6.2% | $127,200 | $7,886.40 |

| 2018 | 6.2% | $128,400 | $7,960.80 |

If a worker starts a new job halfway through the year and during that year has already earned an amount exceeding the Social Security tax wage base limit with the old employer, the new employer is not allowed to stop withholding until the wage base limit has been earned with the new employer (that is, without regard to the wage base limit earned under the old employer). There are some limited cases, such as a successor-predecessor employer transfer, in which the payments that have already been withheld can be counted toward the year-to-date total.

If a worker has overpaid toward Social Security by having more than one job or by having switched jobs during the year, that worker can file a request to have that overpayment counted as a credit for tax paid when he or she files a federal income tax return. If the taxpayer is due a refund, then the FICA tax overpayment is refunded.

Self-employed people

The effective payroll tax rate based on private simulations for different income groups. Effective tax rate equals the payroll taxes paid divided by total income. Total income includes traditional measures of income, imputed undistributed corporate profits, nontaxable employee benefits, income of retirees, and nontaxable income. Payroll taxes include employee and employer FICA.[11]

A tax similar to the FICA tax is imposed on the earnings of self-employed individuals, such as independent contractors and members of a partnership. This tax is imposed not by the Federal Insurance Contributions Act but instead by the Self-Employment Contributions Act of 1954, which is codified as Chapter 2 of Subtitle A of the Internal Revenue Code, 26 U.S.C. § 1401 through 26 U.S.C. § 1403 (the "SE Tax Act"). Under the SE Tax Act, self-employed people are responsible for the entire percentage of 15.3% (= 12.4% [Soc. Sec.] + 2.9% [Medicare]); however, the 15.3% multiplier is applied to 92.35% of the business's net earnings from self-employment, rather than 100% of the gross earnings; the difference, 7.65%, is half of the 15.3%, and makes the calculation fair in comparison to that of regular (non-self-employed) employees. It does this by adjusting for the fact that employees' 7.65% share of their SE tax is multiplied against a number (their gross income) that does not include the putative "employer's half" of the self-employment tax. In other words, it makes the calculation fair because employees do not get taxed on their employers' contribution of the second half of FICA, therefore self-employed people should not get taxed on the second half of the self-employment tax. Similarly, self-employed people also deduct half of their self-employment tax (schedule SE) from their gross income on the way to arriving at their adjusted gross income (AGI). This levels the amount paid by self-employed persons in comparison to regular employees, who do not pay general income tax on their employers' contribution of the second half of FICA, just as they did not pay FICA tax on it either.[12][13]

Exemptions

Exemption for some students

Some student workers are exempt from FICA tax.[14] Students enrolled at least half-time in a university and working part-time for the same university are exempted from FICA payroll taxes if and only if their relationship with the university is primarily an educational one.[15] In order to be exempt from FICA payroll taxes, a student's work must be "incident to" the pursuit of a course of study, which is rarely the case with full-time employment.[16] However full-time college students are never exempt from FICA taxes on work performed off-campus.[16]

Medical residents working full-time are not considered students and are not exempt from FICA payroll taxes, according to a United States Supreme Court ruling in 2011.[16]

A student enrolled and regularly attending classes at a school, college, or university who performs work as a cook, waiter, butler, maid, janitor, laundress, furnaceman, handyman, gardener, housekeeper, housemother, or similar duties in or around the club rooms or house of a local college club, or in or about the club rooms or house of a local chapter of a college fraternity or sorority, are exempt from FICA tax.[17] If the location's primary purpose is to provide room or board, however, then the work is subject to FICA tax.[17] Performing these services for an alumni club or alumni chapter also does not qualify for the exemption from FICA tax.[17]

Exemption for employees of some state governments and local governments

A number of state and local employers and their employees in the states of Alaska, California, Colorado, Illinois, Louisiana, Maine, Massachusetts, Nevada, Ohio, and Texas are currently exempt from paying the Social Security portion of FICA taxes. They provide alternative retirement and pension plans to their employees. FICA initially did not apply to state and local governments, which were later given the option of participating. Over time, most have elected to participate, but a substantial number remain outside the system.[18]

Exemption for certain payments by Native Americans, Native Americans tribal governments, and Native Americans entities

Payments to members of a federally recognized Native American tribe for services performed as council members are not subject to FICA.[19][20]

If a member of a federally recognized Native American tribe that has recognized fishing rights or a qualified Native American entity employs another member of the same Native American tribe for a fishing rights-related activity, the wages are exempt from FICA.[21][20]

Exemption for some nonresident aliens

Some nonresident aliens are exempt from FICA tax.

- Nonresident aliens who are employees of foreign governments are exempt from FICA on wages paid in their official capacities as foreign government employees.[22]

- Nonresident aliens who are employed by a foreign employer as a crew member are exempt from FICA on wages paid for working on a foreign ship or foreign aircraft.[22][23]

- Nonresident aliens who are students, scholars, professors, teachers, trainees, researchers, physicians, au pairs, or summer camp workers and are temporarily in the United States in F-1, J-1, M-1, Q-1, or Q-2 nonimmigrant status are exempt from FICA on wages paid to them for services that are allowed by their visa status and are performed to carry out the purposes the visa status.[22]

- Nonresident aliens who are employees of international organizations are exempt from FICA on wages paid by international organizations.[22]

- Nonresident aliens who are on an H-2A, H-2B, or H-2R visa and are residents of the Philippines are exempt from FICA on wages paid for work performed in Guam.[22]

- Nonresident aliens who are on an H-2A visa are exempt from FICA.[22]

Exemption for members of some religious groups

Members of certain religious groups, such as the Mennonites and the Amish, may apply to be exempt from paying FICA tax.[24][25] These religious groups consider insurance to be a lack of trust in God; the religious groups believe it is their religious duty to provide for its members who are sick, disabled, and elderly.[26]

In order to apply to become exempt from paying FICA tax under this provision, the person must file Form 4029, which certifies that the person:[27]

- Waives the person's rights to all benefits under the Social Security Act;[24]

- Is a member of a recognized religious group that is conscientiously opposed to accepting benefits under a private plan or system that makes payments in the event of death, disability, or retirement, or which makes payments towards the costs of or provides for medical care, including the benefits of any insurance system established by Social Security;[24]

- Is a member of a religious group that makes a reasonable provision of food, shelter, and medical care for its dependent members and has done so continuously since December 31, 1950;[24] and

- Has never received or been entitled to any benefits payable under Social Security programs.[24]

People who claim the above exemption must agree to notify the Internal Revenue Service within 60 days of either leaving the religious group or no longer following the established teachings of the religious group.[25]

Exemption for some aliens on temporary work assignment

When a person temporarily works outside their country of origin, the person may be covered under two different countries' social security programs for the same work.[28] In order to relieve a person of double-taxation, the certain countries and the United States have entered into tax treaties, known as totalization agreements.[28]

Aliens whose employer sends them to the United States on a temporary work assignment may be exempt from paying FICA tax on their earnings from working in the United States if there is a totalization agreement between the United States and the worker's home country.[28] Countries who have such a tax treaty with the United States include Australia,[29]Austria,[30]Belgium,[31]Canada,[32]Chile,[33]Czech Republic,[34]Denmark,[35]Finland,[36]France,[37]Germany,[38]Greece,[39]Hungary, [40]Ireland,[41]Japan,[42]Luxembourg,[43]Netherlands,[44]Norway,[45]Poland,[46]Portugal,[47]Slovakia,[48]South Korea,[49]Spain,[50]Sweden,[51]Switzerland,[52] and United Kingdom.[53]

In order to claim an exemption from paying FICA tax, the alien worker must be on a temporary assignment of no more than five years and the alien worker must have a certificate from the country stating that the worker will continue to be covered by the country's social security system while the worker is in the United States.[28]

Exemption for some family employees

When a parent employs a child under age 18 (or under age 21 for domestic service), payments to the child are exempt from FICA tax.[54][55] The exemption also applies when a child is employed by a partnership in which each partner is a parent of the child.[55][56] The exemption does not apply when the child is employed by a corporation or a partnership with partners who are not the child's parent.[55]

Exemption for foreign governments and some international organizations

Foreign governments are exempt from FICA tax on payments to their employees.[57]International organizations are also exempt if the organization is listed in the International Organizations Immunities Act.[58][59]

If an employee is a U.S. citizen, then the employee must typically pay self-employment tax on earnings from work performed in the United States.[59]

Exemption for services performed by certain individuals hired to be relieved from unemployment

If a state or local government pays individuals for services performed to be relieved from unemployment, the payments to the individuals are exempt from FICA tax.[60] The services must not be performed by individuals under other types of programs.[61] Payments are not exempt from FICA tax if the program's primary purpose is to increase an individual's chances of employment by providing training and work experience.[61]

Exemption for services performed by inmates

Payments to inmates of a prison for services performed for the state or local government that operates the prison are exempt from FICA tax, regardless of the location where the services are performed.[62][61][63] Services performed as part of a work-release program are exempt from FICA tax if and only if the individuals are not considered employees under common law, such as when the individual has control over what work is done and how the work it is done.[61][63][64]

Exemption for services performed by patients

Payments to patients of an institution for services performed for the state of local government that operates the institution are exempt from FICA tax.[62][61] Services performed by patients as part of an institution's rehabilitative program or therapeutic program are exempt from FICA tax.[61]

Exemption for certain emergency workers

If a state or local government's employees were hired on a temporary basis in response to a specific unforeseen fire, storm, snow, earthquake, flood, or a similar emergency, and the employee is not intended to become a permanent employee, then payments to that employee are exempt from FICA tax.[65][66] In order to qualify for the exemption from FICA tax, the employee must have been hired to work temporarily in connection with an unforeseen emergency, such as an individual temporarily hired to battle a major forest fire, to respond to a volcano eruption, or to help people affected by a severe earthquake or flood.[61] Regular long-term police employees and regular long-term fire employees do not qualify under this particular exemption from FICA tax.[61]

Exemption for certain newspaper carriers

Payments to newspaper carriers under age 18 are exempt from FICA tax.[67]

Exemption for some real estate agents and salespeople

Compensation for real estate agents and salespeople is exempt from FICA tax under certain circumstances.[68][69] The compensation is exempt if substantially all compensation is directly related to sales or other output, rather than to the number of hours worked, and there is a written contract stating that the individuals will not be treated as employees for federal tax purposes.[68][69] The individual must typically pay self-employment tax on the compensation.[68][69]

History

Prior to the Great Depression, the following presented difficulties for Americans:

[70]

- The U.S. had no federal-government-mandated retirement savings; consequently, for those people who had not voluntarily saved money throughout their working lives, the end of their work careers was the end of all income.

- Similarly, the U.S. had no federal-government-mandated disability income insurance to provide for citizens disabled by injuries (of any kind—non-work-related); consequently, for most people, a disabling injury meant no more income (since most people have little to no income except earned income from work).

- In addition, there was no federal-government-mandated disability income insurance to provide for people unable to ever work during their lives, such as anyone born with severe mental retardation.

- Further, the U.S. had no federal-government-mandated health insurance for the elderly; consequently, for many people, the end of their work careers was the end of their ability to pay for medical care.

In the 1930s, the New Deal introduced Social Security to rectify the first three problems (retirement, injury-induced disability, or congenital disability). It introduced the FICA tax as the means to pay for Social Security.

In the 1960s, Medicare was introduced to rectify the fourth problem (health care for the elderly). The FICA tax was increased in order to pay for this expense.

In December 2010, as part of the legislation that extended the Bush tax cuts (called the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010), the government negotiated a temporary, one-year reduction in the FICA payroll tax. In February 2012, the tax cut was extended for another year.[71]

In March 2014, the Supreme Court reversed a lower court decision in U.S. v. Quality Stores, Inc. The court held that severance packages are taxable wages for FICA purposes. [72]

Criticism

Payroll and income tax by country

The Social Security component of the FICA tax is regressive. That is, the effective tax rate regresses, or decreases, as income increases beyond the compensation limit or wage base limit amount.[73] The Social Security component is a flat tax for wage levels under the Social Security Wage Base (see "Regular" employees above). Because no tax is owed on wages above the wage base limit amount, the total tax rate declines as wages increase beyond that limit. In other words, for wage levels above the limit, the absolute dollar amount of tax owed remains constant.

The earnings above the wage base limit amount are not, however, taken into account in the Primary Insurance Amount (PIA) to determine benefits payable under the various insurance programs of social security.[74]

The FICA tax also is not imposed on unearned income, including interest on savings deposits, stock dividends, and capital gains such as profits from the sale of stock or real estate. The proportion of total income that is exempt from FICA tax as "unearned income" tends to rise with higher income brackets.

Some, including Third Way, argue that since Social Security taxes are eventually returned to taxpayers, with interest, in the form of Social Security benefits, the regressiveness of the tax is effectively negated.[75] That is, the taxpayer gets back what he or she put into the Social Security system. Others, including The Economist and the Congressional Budget Office, point out that the Social Security system as a whole is progressive in the lower income brackets. Individuals with lower lifetime average wages receive a larger benefit (as both a percentage of their lifetime average wage income and a percentage of Social Security taxes paid) than do individuals with higher lifetime average wages; but for some lower earners, shorter lifetimes may negate the benefits.[76][77][78]

See also

- Cafeteria plan

FICO, a similar initialism sometimes confused with FICA- Form W-2

- Income tax

- Medicare (United States)

National Insurance contribution (NIC), a somewhat similar tax in the United Kingdom- Social Security (United States)

Trust Fund Recovery Penalty, the personal liability of employers who fail to pay the tax

Notes

^ In 2011 and 2012, the employee's portion was temporarily reduced to 4.2%.[8]

References

^ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 367. ISBN 0-13-063085-3..mw-parser-output cite.citation{font-style:inherit}.mw-parser-output .citation q{quotes:"""""""'""'"}.mw-parser-output .citation .cs1-lock-free a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/6/65/Lock-green.svg/9px-Lock-green.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-limited a,.mw-parser-output .citation .cs1-lock-registration a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/d/d6/Lock-gray-alt-2.svg/9px-Lock-gray-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-subscription a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/a/aa/Lock-red-alt-2.svg/9px-Lock-red-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration{color:#555}.mw-parser-output .cs1-subscription span,.mw-parser-output .cs1-registration span{border-bottom:1px dotted;cursor:help}.mw-parser-output .cs1-ws-icon a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/4/4c/Wikisource-logo.svg/12px-Wikisource-logo.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output code.cs1-code{color:inherit;background:inherit;border:inherit;padding:inherit}.mw-parser-output .cs1-hidden-error{display:none;font-size:100%}.mw-parser-output .cs1-visible-error{font-size:100%}.mw-parser-output .cs1-maint{display:none;color:#33aa33;margin-left:0.3em}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration,.mw-parser-output .cs1-format{font-size:95%}.mw-parser-output .cs1-kern-left,.mw-parser-output .cs1-kern-wl-left{padding-left:0.2em}.mw-parser-output .cs1-kern-right,.mw-parser-output .cs1-kern-wl-right{padding-right:0.2em}

^ JCX-49-11, Joint Committee on Taxation, September 22, 2011, pp 4, 50.

^ "Policy Basics: Federal Payroll Taxes". Center on Budget and Policy Priorities. April 15, 2013. Retrieved November 17, 2013.

^ Kevin A. Hassett, March 29, 2005, "Is the Payroll Tax a Tax?" National Review Online, at nationalreview.com

^ CHAPTER 21—Federal Insurance Contributions Act from the Legal Information Institute at Cornell Law School

^ Studies Shed New Light on Effects of Administration's Tax Cuts by David Kamin and Isaac Shapiro, Center on Budget and Policy Priorities, Revised September 13, 2004

^ ab "Contribution and Benefit Base". Social Security Administration. November 2017. Retrieved November 30, 2017.

^ abc "Social Security & Medicare Tax Rates". Social Security Administration. Retrieved November 30, 2017.

^ Internal Revenue Code Section 3111. Tax Almanac.

^ "OASDI and SSI Program Rates & Limits, 2018". Social Security Administration. November 2017. Retrieved November 30, 2017.

^ Table T11-0099, Effective Federal Tax Rates Under Current Law, By Total Income Percentile, 2010, Tax Policy Center.

^ I am self-employed. How do I pay Social Security tax?. Social Security Administration. Retrieved on April 28, 2007.

^ Self-Employment Tax. Internal Revenue Service. Retrieved on April 28, 2007.

^ "26 CFR 31.3121(b)(10)-2". via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018.

^ Rev. Proc. 2005-11 (pdf). Internal Revenue Service. April 1, 2005. p. 5.

^ abc Mayo Foundation for Medical Education and Research Et Al. v. United States (pdf). Supreme Court of the United States. January 11, 2011.

^ abc "26 CFR 31.3121(b)(2)-1". via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018.

^ Miller, Girard. "The FICA Free-Lunch Crowd". Governing. August 12, 2010.

^ "Revenue Ruling 59-354", 1959-2 C.B. 24.

^ ab "Federal-State Reference Guide". Internal Revenue Service. November 2004. p. 2-6.

^ Notice 89-34, 1989-1 C.B. 674

^ abcdef "Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees". Internal Revenue Service. August 23, 2016. Retrieved May 12, 2017.

^ "26 CFR 31.3121(b)(4)-1". via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018.

^ abcde "Are members of religious groups exempt from paying Social Security taxes?" Social Security Administration. January 9, 2017. This article incorporates text from this source, which is in the public domain.

This article incorporates text from this source, which is in the public domain.

^ ab "Form 4029: Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits". Internal Revenue Service. September 2014.

^ Green, Parman R. "Taxation Tidbit The Amish – Social Security and Medicare Taxes". University of Missouri. Retrieved May 12, 2017.

^ "RS 01802.273 Method of Obtaining Exemption — Process". Social Security Administration. April 2006.

^ abcd "International Agreements: U.S. International Social Security Agreements". Social Security Administration. Retrieved May 12, 2017.

^ "Totalization Agreement with Australia". Social Security Administration. January 2004.

^ "Totalization Agreement with Austria". Social Security Administration. May 2005.

^ "Totalization Agreement with Belgium". Social Security Administration. January 2004.

^ "Totalization Agreement with Canada". Social Security Administration. January 2004.

^ "Totalization Agreement with Chile". Social Security Administration. October 2013.

^ "Totalization Agreement with the Czech Republic". Social Security Administration. February 2009.

^ "Totalization Agreement with Denmark". Social Security Administration. October 2008.

^ "Totalization Agreement with Finland". Social Security Administration. July 2008.

^ "Totalization Agreement with France". Social Security Administration. May 2012.

^ "Totalization Agreement with Germany". Social Security Administration. May 2005.

^ "Totalization Agreement with Greece". Social Security Administration. September 2008.

^ "U.S.-Hungary Social Security Agreement". Social Security Administration. February 3, 2015.

^ "Totalization Agreement with Ireland". Social Security Administration. July 2005.

^ "Totalization Agreement with Japan". Social Security Administration. August 2005.

^ "Totalization Agreement with Luxembourg". Social Security Administration. January 2005.

^ "Totalization Agreement with the Netherlands". Social Security Administration. March 2011.

^ "Totalization Agreement with Norway". Social Security Administration. January 2004.

^ "Totalization Agreement with Poland". Social Security Administration. March 2011.

^ "Totalization Agreement with Portugal". Social Security Administration. May 2009.

^ "U.S.-Slovak Social Security Agreement". Social Security Administration. December 10, 2012.

^ "Totalization Agreement with Korea". Social Security Administration. January 2004.

^ "Totalization Agreement with Spain". Social Security Administration. November 2005.

^ "Totalization Agreement with Sweden". Social Security Administration. July 2007.

^ "Totalization Agreement with Switzerland". Social Security Administration. April 2005.

^ "Totalization Agreement with the United Kingdom". Social Security Administration. May 2005.

^ "26 CFR 31.3121(b)(3)-1". via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018.

^ abc "Publication 15: (Circular E), Employer's Tax Guide". Internal Revenue Service. 2017. p. 12–13.

^ "26 CFR 31.3121(b)(3)-1(c)". via Legal Information Institute, Cornell University Law School. Retrieved December 23, 2018.

^ "Publication 15: (Circular E), Employer's Tax Guide". Internal Revenue Service. 2017. p. 37.

^ 22 U.S.C. 288-288f.

^ ab "Persons Employed by a Foreign Government or International Organization - Federal Insurance Contributions Act (FICA)". Internal Revenue Service. October 31, 2016.

^ "Internal Revenue Code Section 3121(b)(7)(F)(i)". Internal Revenue Service. Retrieved November 19, 2018.

^ abcdefgh "Publication 963". Internal Revenue Service. November 2011. p. 3-22.

^ ab "Internal Revenue Code Section 3121(b)(7)(F)(ii)". Internal Revenue Service. Retrieved November 19, 2018.

^ ab Bowen, Denise Y. (January 2006). "Amounts Paid to Inmates". Federal, State and Local Governments (FSLG) Newsletter. Internal Revenue Service. p. 3–5.

^ "Employee (Common-Law Employee)". Internal Revenue Service. April 23, 2018.

^ "Internal Revenue Code Section 3121(b)(7)(F)(iii)". Internal Revenue Service. Retrieved November 19, 2018.

^ "Publication 15: (Circular E), Employer's Tax Guide". Internal Revenue Service. 2017. p. 38.

^ "Publication 15: (Circular E), Employer's Tax Guide". Internal Revenue Service. 2017. p. 39.

^ abc "Publication 15: (Circular E), Employer's Tax Guide". Internal Revenue Service. 2017. p. 40.

^ abc "Publication 15-A: Employer's Supplemental Tax Guide". Internal Revenue Service. 2017. p. 6–7.

^ Historical Background and Development of Social Security Social Security Administration

^ "Congress passes extension of payroll tax cut, unemployment benefits". CBS News.

^ UNITED STATES v. QUALITY STORES, INC. et al. by the Supreme Court of the United States, retrieved May 2, 2014

^ Social Security Snares & Delusions by Irwin Stelzer, The Weekly Standard. Retrieved July 23, 2008

^ "Contribution And Benefit Base". Social Security Administration. Retrieved 6 July 2018.

^ Kessler, Jim; Brown, David (July 2013). "Is Social Security Regressive?" Third Way.

^ Is Social Security Progressive? by the Congressional Budget Office, retrieved July 23, 2008

^ Slemrod, Joel E. "Progressive Taxes". Concise Encyclopedia of Economics. Retrieved March 24, 2012.[T]he progressivity of the tax structure cannot be judged by looking at only one component of taxes.... In recent years the fastest-growing component of federal taxes has been the payroll tax, which is regressive (the opposite of progressive) in its impact, because it taxes at a flat rate only on wages below $63,400 (in 1991). The Social Security system, however, is progressive because it pays higher benefits—relative to taxes paid in—to lower-income workers.

^ "Are Social Security taxes regressive?". The Economist. April 14, 2009. Retrieved March 24, 2012.

External links

Annual maximum taxable earnings and contribution rates, 1937-2006, from the Social Security Administration

Summary of Social Security Amendments of 1983, from the Social Security Administration

Student Exception to FICA Tax, from the Internal Revenue Service

Go Ahead and Lift the Cap, discussing 2008 US presidential campaign plans regarding payroll taxes, from Dollars & Sense magazine